Location:

Ritz Carlton New Orleans

921 Canal Street

New Orleans, LA 70112

The Ritz is located in the French Quarter on Canal Street, approximately 30 miles from Louis Armstrong New Orleans International Airport.

Program:

Registration for the Sales Tax Conference/Audit Session is from noon to 8:00 p.m. on Monday, February 26th and the conference will conclude at 12:00 p.m. on Thursday, March 1st.

The goal of this program is to bring multistate tax professionals, with various levels of experience in transactional taxes, together in a group live environment that allows for extensive interaction and exchange of information as well as updates on key SALT issues and insights regarding state tax trends and opportunities. The program is targeted to all levels of experience and no advance preparation is needed.

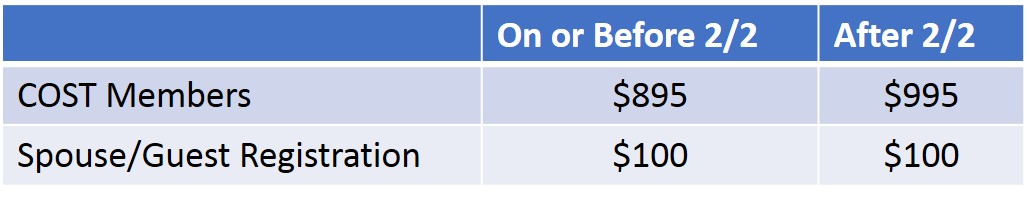

Registration Fees:

NOTE: Company must be a COST Industry Member to attend.

Cancellation Fees:

A $50 cancellation fee will be imposed for cancellations received on or before February 5, 2018; cancellations after February 5th will not be refunded.

Your company must be in good standing with COST at time of registration and time of program in order for its employees to attend the Sales Tax Conference & Audit Session. For complaints and special refund policies you can contact Karen Galdamez ([email protected]), 202.484.5220.

Hotel Reservations:

Rooms have been reserved at a rate of $229 single/double (plus taxes). Please make your hotel reservations directly with the Ritz Carlton at 504.524.1331 and let them know you are attending the Council On State Taxation Sales Tax Conference or reference special rate code CXVCXA. For online reservations, click here.

We encourage you to make your room reservations early as rooms in the COST block and hotel will sell out. Note: February 5th is the room reservation cut-off date. Rooms at the group rate may not be available if the COST room block sells out prior to February 5th. Please note: for reservations outside of the group dates, the code will not be valid and the rooms are on an “as available” basis.

Continuing Education:

COST will assist you in applying for Continuing Education credit for the COST 2018 Sales Tax Conference/Audit Session. COST is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

Weather:

February’s average high in New Orleans is in the high 60’s and the average low is in the low 50’s. Dress for the conference is business casual. We encourage you to bring a sweater or jacket to the meeting as the meeting rooms tend to be on the cooler side.

Permission:

By registering for COST’s conferences, workshops or schools, attendees hereby agree to allow COST to use any photos taken of them during the conference/workshop/school in news media, website, publications, articles, marketing pieces and etc.

For More Information:

Please contact Karen Galdámez: [email protected]